The rise of digitization in India has brought sweeping changes, with one of the most significant being the adoption of the Unified Payments Interface (UPI). Launched in 2015, UPI revolutionised banking by empowering popular apps like BHIM UPI, Google Pay, and PayZapp. Now, leaving home without cash is no longer a worry because your phone serves as your wallet.

However, alongside its convenience, UPI has also brought challenges, notably in the form of scams. Cyber scams, already a prevalent threat, have amplified with UPI's popularity, leading to a surge in digital payment fraud in India. According to the RBI Annual Report, digital payment fraud reached a record 14.57 billion rupees ($175 million) in the fiscal year ending March 2024.

Let's explore the common UPI scams plaguing users today and learn how to safeguard against these prevalent UPI scams.

Phishing Scams

Phishing scams are among the most common UPI scams. Similar to typical internet scams, victims receive deceptive emails containing phishing links. Clicking on these links allows fraudsters to illicitly obtain your UPI PIN, facilitating unauthorised transactions. It is crucial to exercise caution with emails. Take a moment to verify their authenticity before taking any action. Avoid clicking on suspicious links to prevent falling victim to phishing scams.

Phishing scams are among the most common UPI scams. Similar to typical internet scams, victims receive deceptive emails containing phishing links. Clicking on these links allows fraudsters to illicitly obtain your UPI PIN, facilitating unauthorised transactions. It is crucial to exercise caution with emails. Take a moment to verify their authenticity before taking any action. Avoid clicking on suspicious links to prevent falling victim to phishing scams.

QR Code Frauds

A significant aspect of the UPI system involves scanning QR codes for payments. Unfortunately, fraudsters exploit this feature by creating counterfeit QR codes to deceive and steal money from unsuspecting individuals. This fraudulent practice, often termed as 'quishing,' proliferates through popular communication channels like WhatsApp and Instagram. To mitigate such common UPI scams, it is advisable to prioritise direct transfers to verified UPI IDs. This approach minimises the risk of falling prey to fraudulent QR codes and safeguards against financial losses.

SIM Swapping Scams

SIM Swapping Scams are a serious threat, where scammers exploit vulnerabilities in SIM cards linked to UPI apps to intercept OTPs and conduct fraudulent transactions. This common UPI scam involves acquiring SIM cards through illegal means such as the dark web or leaked data from service providers. To protect yourself, safeguard your SIM card and promptly report any suspicious activity to your service provider. Enhance your security by opting for biometric authentication for UPI transactions.

Fake Payment Apps

Fraudulent payment apps are a prevalent issue where scammers create deceptive UPI handles to dupe unsuspecting users. These scams typically manifest across social media, online marketplaces, or via unsolicited messages. To lure victims, fraudsters often dangle attractive offers or create a sense of urgency, coercing users into making transactions to their fraudulent UPI handles. It's crucial to exercise caution and verify the authenticity of UPI handles before proceeding with any transactions to avoid falling victim to such scams.

Fraudulent payment apps are a prevalent issue where scammers create deceptive UPI handles to dupe unsuspecting users. These scams typically manifest across social media, online marketplaces, or via unsolicited messages. To lure victims, fraudsters often dangle attractive offers or create a sense of urgency, coercing users into making transactions to their fraudulent UPI handles. It's crucial to exercise caution and verify the authenticity of UPI handles before proceeding with any transactions to avoid falling victim to such scams.

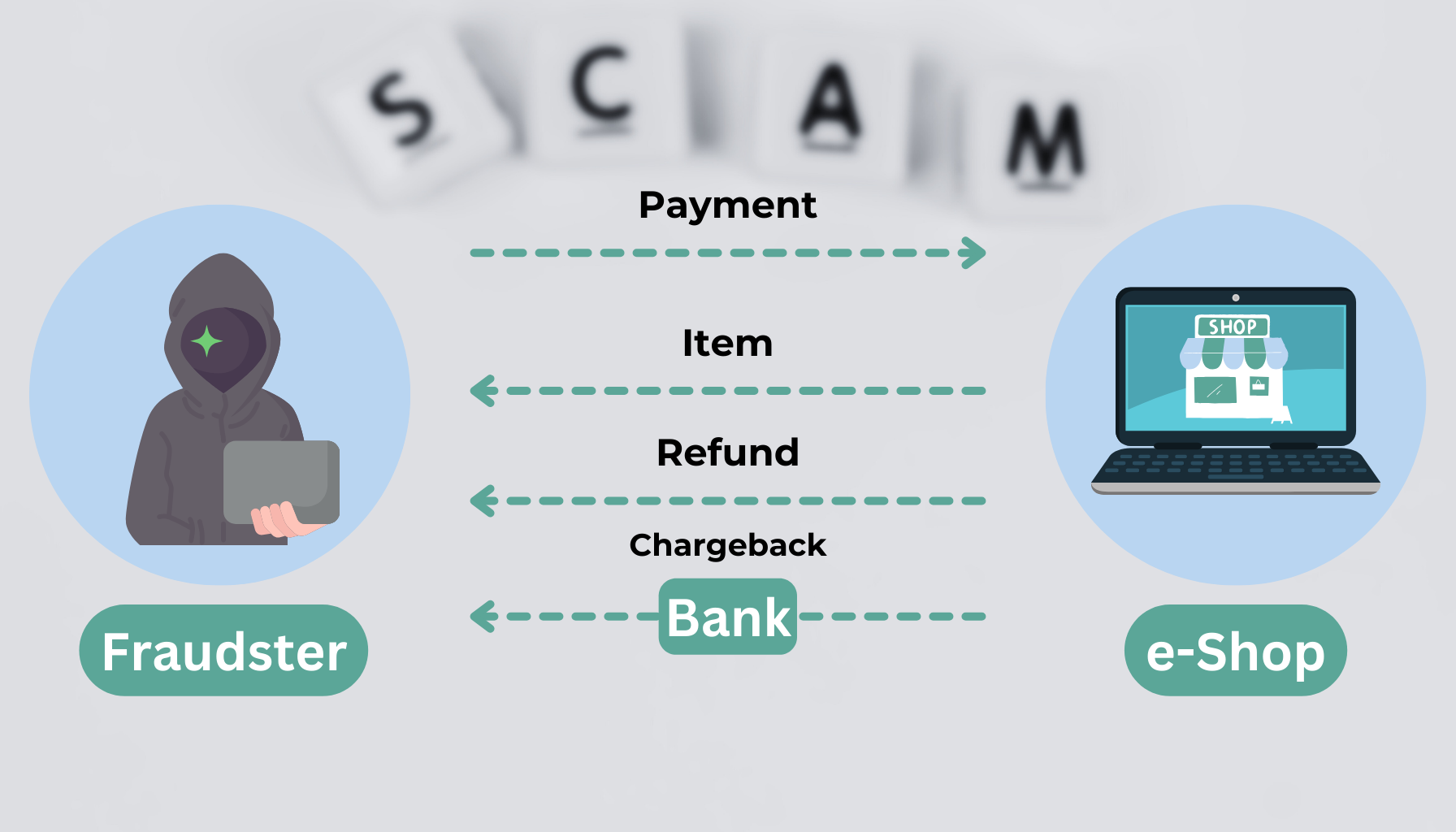

Overcharging and Double Dipping

In this common UPI scams, scammers send a nominal amount and then request you to refund an inflated sum, typically twice the original amount. This tactic leverages urgency, forcing victims into quick transactions.

In such scenarios, staying composed is crucial to avoid falling prey to scams. Scammers exploit urgency to pressure you into transferring funds hastily. The first step is always to verify and then proceed cautiously. If you receive unexpected funds from an unfamiliar source, it's essential to report the incident and refrain from complying with any repayment requests made by the sender.

In conclusion, the widespread adoption of the Unified Payments Interface (UPI) has undoubtedly revolutionised digital transactions in India, making cashless payments more accessible than ever before through popular apps like BHIM UPI, Google Pay, and PayZapp. However, alongside the convenience, the rise of UPI has also led to a surge in cyber scams, including phishing scams, QR code frauds, SIM swapping scams, fake payment apps, and overcharging schemes.

These common UPI scams pose significant risks to users, leading to substantial financial losses and breaches of privacy. To safeguard against these threats, it's crucial to remain vigilant and exercise caution. Always verify the authenticity of communications and transactions, avoid clicking on suspicious links, secure your SIM card, and opt for secure UPI IDs for transactions. By staying informed and proactive, individuals can protect themselves from falling victim to these prevalent UPI scams and ensure safe digital transactions in an increasingly interconnected world.

These common UPI scams pose significant risks to users, leading to substantial financial losses and breaches of privacy. To safeguard against these threats, it's crucial to remain vigilant and exercise caution. Always verify the authenticity of communications and transactions, avoid clicking on suspicious links, secure your SIM card, and opt for secure UPI IDs for transactions. By staying informed and proactive, individuals can protect themselves from falling victim to these prevalent UPI scams and ensure safe digital transactions in an increasingly interconnected world.