Cybersecurity today is multifaceted as all industries have embraced digitalisation. Stock markets, being the nexus of financial transactions and sensitive data, are particularly susceptible to cyber threats. The increasing sophistication of cyber-attacks, coupled with the high stakes involved in financial trading, underscores the critical need for robust cybersecurity in stock market.

Unlike traditional cybersecurity measures that often focus on reactive defence, threat intelligence provides a proactive approach. Threat intelligence is a term that involves the collection and analysis of information about current and potential attacks that threaten the safety of the stock market ecosystem.

The Landscape of Cyber Threats in Stock Markets

The tactics employed by cybercriminals in targeting financial institutions have evolved significantly. Initially, attacks were largely focused on direct financial theft through methods like wire fraud and credential phishing. However, recent trends indicate a shift towards more sophisticated attacks changing the dynamics of cybersecurity in stock market. Here are some tactics employed by cybercriminals targeting financial institutions:-

-

Advanced Persistent Threats (APTs): These are prolonged and targeted cyber attacks in which an intruder gains access to a network and remains undetected for an extended period.

-

Ransomware and Denial-of-Service (DoS) Attacks: These involve encrypting an institution’s data or overwhelming their systems, rendering them inoperable, often accompanied by demands for ransom.

-

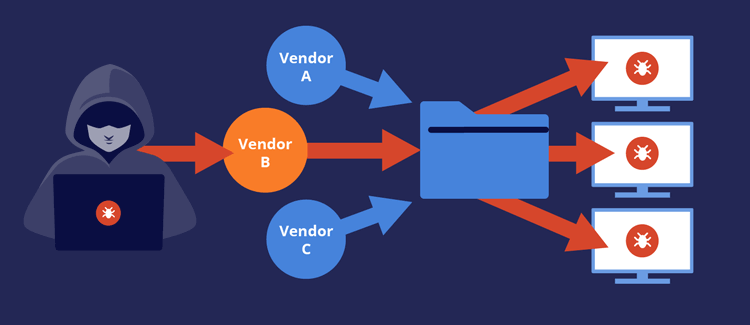

Supply Chain Attacks: Cybercriminals are increasingly targeting smaller, less secure companies that provide services to larger financial institutions, exploiting these relationships to gain access to the larger networks.

Understanding Cybersecurity Threat Intelligence

Cybersecurity threat intelligence is a critical component in the arsenal of digital defence, especially for high-stakes environments like stock markets. In the context of stock markets, threat intelligence becomes pivotal in safeguarding not only the digital infrastructure, but also the financial assets and investor trust vested in these institutions.

Cybersecurity threat intelligence can be categorised into three primary types, each serving a distinct purpose:

-

Strategic Threat Intelligence: This type of intelligence provides a broader perspective of an enterprise's cybersecurity landscape, focusing largely on ongoing & upcoming trends and the incentive behind cyber attackers.

-

Tactical Threat Intelligence: Tactical intelligence delves into the tactics, techniques and procedures (TTPs) used by cybercriminals. It provides insights into how threat actors breach defences, steal data or disrupt operations. Organisations can bolster their defence with tactical threat intelligence by detecting and responding to cyber threats effectively.

-

Operational Threat Intelligence: Operational intelligence is focused on imminent and ongoing cyber threats. It provides detailed information about the nature, timing and potential targets of cyber attacks.

The Importance of Timely Information

In a high-stake environment like the stock market, time is a crucial factor. Timely information helps organisations to stay ahead of the attackers and minimise the detrimental impact.

Proactive threat intelligence will ensure effective cybersecurity in the stock market. It involves actively seeking out and analysing information to prevent attacks before they occur. This approach ensures the security and stability of financial operations in this increasing digital environment.

Challenges in Cybersecurity Threat Intelligence

Threat intelligence plays a crucial role in helping organisations anticipate and mitigate potential cyber threats. However, effectively leveraging threat intelligence can be a complex task. Here are some common challenges faced by organisations:

Volume and Complexity of Data: Organisations often struggle with the overwhelming amount of data, making it difficult to identify relevant threat intelligence from the noise.

Lack of Skilled Personnel: There is a shortage of skilled cybersecurity professionals who can analyse and interpret threat intelligence effectively (Business Standard).

Integration with Existing Systems: Effectively integrating threat intelligence into existing security systems and workflows can be challenging.

Here are some potential solutions to address these challenges:

-

Implementing Advanced Analytics and AI: Utilising artificial intelligence and machine learning can help in managing large volumes of data, identifying patterns and extracting actionable insights.

-

Training and Development: Investing in training for existing staff and attracting skilled cybersecurity professionals can enhance an organisation's capability to utilise threat intelligence effectively.

-

Customised Integration Solutions: Developing tailored solutions for integrating threat intelligence into existing security infrastructures can maximise efficiency and effectiveness.

Conclusion

The stock market's cyber threat landscape is ever-changing, with advanced threats like APTs, ransomware and social engineering. Cybersecurity threat intelligence is crucial for anticipating and mitigating these risks, requiring timely and accurate information for effective response. In India, entities like CERT-In and NCIIPC, along with private firms, are key in providing this intelligence. However, challenges such as data overload, skill shortages and integration difficulties persist, necessitating solutions like advanced analytics and collaborative efforts.

Cybersecurity in stock market is vital for protection against destructive threats. It offers foresight and preparedness against cyber threats, ensuring transaction security and investor confidence. As cyber threats evolve, so must response strategies, making threat intelligence a key tool for adaptive resilience. It serves as both a defensive mechanism and a strategic asset, crucial for informed decision-making and upholding the global financial system's trust and stability.